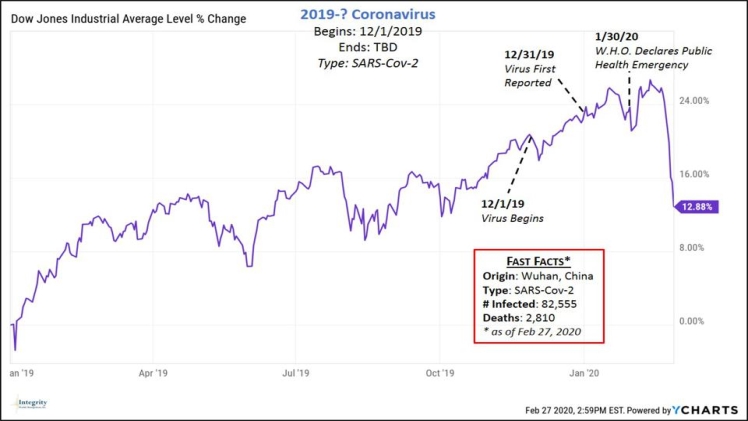

The spread of Covid-19 worldwide and the high contamination rates continue to give rise to many concerns. In addition to the pandemic’s tragic human consequences, the Covid-19 generates uncertainties in the global financial markets.

The impact of COVID 19

The collapse of world markets in March 2020 seems distant as the rise in indices has been rapid and spectacular. However, the traces it left on the economic and financial landscape are still visible, and some seem indelible.

The COVID-19 crisis had accelerated trends that were already at work before it. It confirmed a request for state intervention almost everywhere. And further dented the need for structural reforms, fiscal rectitude, and inflation control.

Other trends accelerated by the crisis are certainly more lasting. Particularly the shift of the focus of the geopolitical and economic world towards Asia in general. And especially towards China, which has just demonstrated its capacity to manage the pandemic while boosting its economy.

Indeed, some economic sectors felt massive losses such as restaurants, shops, and the travel industry.With these circumstances, it resulted in the downturn of the labor market. As such, COVID-19 has affected the remittance flows globally. Moreover, other businesses that rely on the tourism and hospitality sector had to deal with the catastrophic financial consequences. The uncertain economic environment also made individuals with a stable and decent income spend less in the event of a possible financial aftershock.

A good year for risky assets investment

The great paradox of the year 2020 was an economic crisis’s coexistence with new historical records for many international stock indexes. The health crisis has generated a severe economic depression and social catastrophe. It nevertheless resulted in a good year for so-called risky financial assets such as stocks and cryptocurrencies.

In 2020, most US stocks were strongly bullish, particularly the Nasdaq technology stars who made spectacular profits. Also, the biotech startup business turned out to be profitable, with stock prices soaring due to the anti Covid vaccine race.

The cryptocurrency market for many represented the big unknown. But, the crypto prices went through the roof. Also, the awareness of financial institutions about the importance of crafting legislation regarding cryptocurrencies increased. Hence the crypto market gets more important. Also, it becomes more correlated with other financial markets. According to analysts, the number of cryptocurrency users will increase four times in the next decade, with bitcoin prices predicted to reach $500 000 by 2030.

The vulnerability of the financial markets is certainly pronounced during these pandemic times. Naturally, it reflects on people’s personal finances and raises many questions without a certain answer. Those working in hard-hit industries might have to start thinking of new job opportunities and looking for alternative income sources to create emergency funds. Forex trade still remains at the forefront when it comes to online trading. The market represents the first choice of investment for many ordinary people forced to stay at home due to pandemic circumstances. The opportunities for profits for retail investors turn out to be tremendous. The volatility in currency prices opens a way for many daily traders and speculators to profit from the ongoing market conditions.